How will filing a Chapter 13 Improve my Credit?

How will filing a Chapter 13 Improve my Credit?

Chapter 13 is debt management program designed to improve credit over the course of the 36- 60 repayment process. There are two main functions of credit and this is how the Chapter 13 bankruptcy process addresses each:

1.) Debt-to-Income Ratio or Leverage:

This accounts for the percentage of your monthly gross monthly income that goes towards paying debt each month. Your credit is negatively impacted if you are over-leveraged. This means that too much of your income is going towards paying off debts rather than paying your normal living expenses.

The Chapter 13 process reduces your debt-to-income ratio each month that you are paying into the established repayment plan. Since all unsecured debts and arrearages are paid back at 0% interest, your monthly plan payments reduce principal balances versus just servicing the interest on the debt.

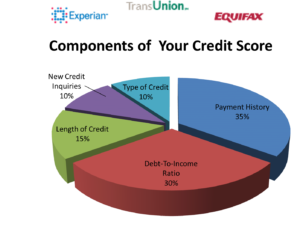

Since your debt-to-income ratio accounts for 30% of your credit score according to FICO, improving it could have a dramatic impact on your score. As your debt-to-income ratio improves throughout the course of the Chapter 13, so also will your credit score.

2.) Consistent and timely Payments to Creditors:

Juggling bills at the end of each month may mean a late or missed payment to some of your creditors. The Chapter 13 resolves this issue by creating an orderly repayment for all of your creditors. The Chapter 13 prioritizes your income in the following way:

+ Payments on secured debts and back-payments on secured debts (first mortgage, vehicle payment, arrearages, etc.)

+ Your monthly living expenses (groceries, gas, utilities, etc.

+ Payments towards any priority debts such as income tax debts

+ Whatever funds are left over (if any) after the above deductions, are paid towards your pool of unsecured creditors, such as credit cards, medical bills, etc.

Most often, the unsecured creditors are paid back at a reduced rate. At the end of the program, any remaining balances are eliminated or discharged.

While you are under the court protection of a Chapter 13 personal bankruptcy, there is no more “late” reports to the credit agencies. Based on your payment into the plan, a court-appointed Trustee makes consistent monthly payments to your creditors based on the above described hierarchy. This restores and ensures timely payments to your creditors. According to FICO, your payment history has the biggest impact on your credit score, comprising 35% of your credit score.

Based on an improved debt-to-income ratio and restored timely payments to creditors, 65% of your credit score factors are improved through filing Chapter 13 bankruptcy.

We are here to answer your questions and provide qualified legal advice. Don’t delay getting your credit and life back on track – call us today at 734-722-2999 for your free consultation.

Previous Post

Previous Post